2022 var et dårlig år for DeFi- -bransjen

DeFi is an inseparable part of the crypto-market

As it has been mentioned, now the cryptocurrency market keeps moving downward. There are moments when one of the cryptocurrency sectors starts to grow anomalously for a while, as it happened to NFTs. Nevertheless, non-fungible tokens bounced back to move downward along the crypto-market.

The sector of decentralized finances (DeFi) was not an exception here. The recent weeks have not been standing out among the previous ones. Several crypto-assets from Top-100 digital currencies have had a bad result despite the biggest level of capitalization and popularity. These coins suffered much: their value dropped 20%, 30%, 40% and even more.

Neutrino USD — stablecoin that has lost its stablecoin status

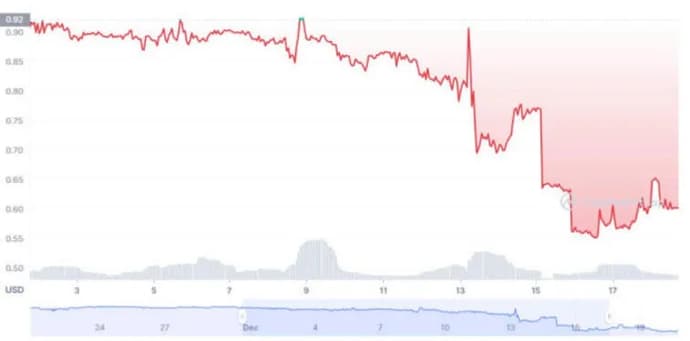

The coin Neutrino USD showed one of the worst results. The token of the exchange is in the 78th position at the moment and is about to exit Top-80 coins with the biggest level of capitalization. It is remarkable that the name of the token suggests that this is a stablecoin.

This is what the coin used to be, however, in March 2022 it slipped to $0,94 and after that restored to $0,97. The drop to $0,82 and $0,92 occurred in May and September, and starting from 5 December the token started to show a miracle of a steep dive and at the moment of this article being written, the cost of NUSD fell to $0,54 which is twice as low as a normal stablecoin. Therefore, deprivation of the status could be called one of the worst-case scenarios which can happen to a token related to decentralized exchanges.

In December, Neutrino USD slipped to 41%, and the capitalization of Neutrino USD exceeds $367,700,000.

Serum

Another coin with rather bad results was Serum. Recently the token has been showing unsatisfactory results but if we consider the previous months we have been able to notice an impressive reduction since the beginning of November. Then 1 token cost more than $0,80, and nowadays the value has dropped to $0,16 and keeps on falling.

The market capitalization has also been affected dramatically which depends on the cost directly. If the total supply of the coin consisted of several hundreds of millions dollars, now this figure has dropped to $42,000,000. The trading volume held by traders has been worse. Last night showed $9,000,000 of Serum’s buying and selling.

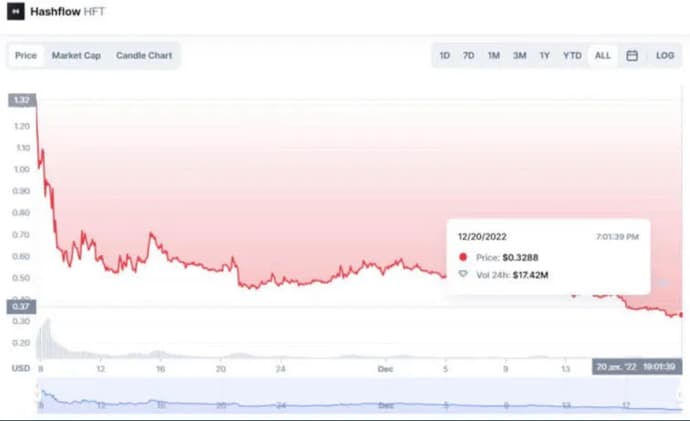

Hashflow

Another project that shows unsatisfactory results is Hashflow (HFT). This platform shows that there are such decentralized exchanges that lose their audience and the situation cannot improve. At the beginning of November when the DeFi project Hashflow appeared, the token was valued at $1,32, and daily trading volume exceeded $500,000,000 and $600,000,000 and even $700,000,000.

At the moment the cost has dropped to $0,32, and the volume of daily trades declined to $17,000,000, however, even this result is better than what happened to Serum. Capitalization of HFT is slightly over $57,000,000.

The decline of TVL (total value locked)

If we look at the sector of decentralized exchanges more globally, you can notice that the locked finances on DeFi platforms have significantly decreased in comparison to what we could see in 2021. In 2022, nearly 70% of finances were withdrawn from decentralized exchanges.

This is explained by numerous failures and bankruptcies we could witness throughout the year. We can think of Terra, Three Arrows Capital, FTX, Alameda Research, Voyager Digital and many other exchanges that have already suffered because of their financial insufficiency, or they are just going to declare bankruptcy in a short while. Several times a week we get news about closing exchanges because of the FTX issues and it will continue for a while.

Getting back to the topic with locked value on exchanges, experts of the analytics service CryptoCompare reported unsatisfactory results in 2022. According to the, the DeFi structure was severely damaged. It is worth explaining the term TVL that sets DeFi platforms apart from regular brokers. One of the main features of the platforms for interaction with decentralized finances is an opportunity of cloud staking with entering money on stock exchange and blocking it for a while.

The period of blocking money for owners is different on all platforms. On some, users have a chance to set the block of their money for several months, or even years, while on other DeFi platforms like PancakeSwap, there is a chance to withdraw money whenever you want.

According to the experts from Из-за краха бирж по заявлениям экспертов из CryptoCompare the collapse of the exchange resulted in a decline of the percent of total value locked (TVL) investors to 70,1% in 2022. At the beginning of 2022, the total amount of finances on platforms exceeded $75,300,000,000. Now the level of TVL dropped to $22,500,000,000.

If we consider not all decentralized exchanges but only those that are in Top-50 in terms of market capitalization, the result will be more gentle, but still impressive. It was noticed on decentralized platforms that users withdrew 67,6% of their financial savings.

Positive expectations

Experts noticed that despite the fact that TVL was reduced, in total the sector of decentralized exchanges got more popular than before. According to analysts, DeFi platforms gave cryptocurrency enthusiasts a chance to earn money even if they did not have access to regular banks.

It is a paradox but the collapse of the exchanges that repelled investors that have lost trust gave interest to the same investors who were left penniless on regular cryptocurrency exchanges. The reason is the specifics of decentralized platforms that is hidden in the name of the sector. Unlike regular exchanges where all finances are stored in one place and can be lost because of force-majeure circumstances, money on DeFi platforms is spread around the whole blockchain which increases its security.

Therefore, people, who do not want to transfer their money to hardware wallets or withdraw it, had a chance to put aside finances on such platforms and send them to cloud staking. You can doubt the profit of this offer, considering the fact that the cost of tokens is falling, however, if you make an investment during the crypto winter and wait for a new bullish cycle, apart from the Xs, you can earn additional interest from this investment in the medium and long-term.

Experts claim that the following year must give a second breath to the sector of decentralized exchanges and DeFi protocols will gain more popularity and attention.

We should note that in the eyes of top-management of regular exchanges, DeFi protocols are the main counterpart that may deprive their work in the future. For instance, recently the Chief Financial Officer of Binance reported that if decentralized exchanges continue developing at their current paces, the exchange from Hong Kong may cease its existence.

If DeFi platforms can develop to the level that people can save their money there, earning some interest without fear, the sector of decentralized finances can replace centralized exchanges.

Takeaway

As a result, we see that the DeFi sector suffered as much as the whole cryptocurrency industry in 2022, however, experts are sure that this is temporary and next year we will be able to see this sector of the industry healed and it should cause the beginning of a new era of cryptocurrencies.

Bogdan Lashchenko - innholdssjef hos EgamersWorld.Bogdan har jobbet hos EGamersWorld siden 2023. Da han begynte i selskapet, begynte han å fylle nettstedet med informasjon, nyheter og arrangementer.

Hytale: Ryggsekkoppskrift og veiledningHer er guiden din til hvordan du lager en ryggsekk i Hytale, slik at du kan utvide beholdningen din for større eventyr i Orbis.

Hytale: Ryggsekkoppskrift og veiledningHer er guiden din til hvordan du lager en ryggsekk i Hytale, slik at du kan utvide beholdningen din for større eventyr i Orbis. Roblox Anime Guardians Koder februar 2026Oppdag alle fungerende Roblox Anime Guardians-koder. Løs inn gratis Mystic Coins, Trait Rerolls, Artefakter og belønninger.

Roblox Anime Guardians Koder februar 2026Oppdag alle fungerende Roblox Anime Guardians-koder. Løs inn gratis Mystic Coins, Trait Rerolls, Artefakter og belønninger. Ikke-britiske nettkasinoer: Spill, formater og hva spillere kan forventeNettkasinoer som opererer utenfor det britiske rammeverket for pengespill, tiltrekker seg oppmerksomhet på grunn av forskjeller i lisensmodeller, spillporteføljer og...

Ikke-britiske nettkasinoer: Spill, formater og hva spillere kan forventeNettkasinoer som opererer utenfor det britiske rammeverket for pengespill, tiltrekker seg oppmerksomhet på grunn av forskjeller i lisensmodeller, spillporteføljer og... Bitcoin-kasinoer og kryptospillplattformer for britiske spillereKryptobaserte spillplattformer har blitt et merkbart segment av det globale markedet for nettkasinoer.

Bitcoin-kasinoer og kryptospillplattformer for britiske spillereKryptobaserte spillplattformer har blitt et merkbart segment av det globale markedet for nettkasinoer.